All Categories

Featured

Table of Contents

Indexed global life policies provide a minimum surefire rate of interest price, additionally understood as an interest attributing floor, which lessens market losses. Say your cash money worth sheds 8%.

A IUL is a long-term life insurance plan that obtains from the properties of a global life insurance policy. Unlike universal life, your money worth grows based on the efficiency of market indexes such as the S&P 500 or Nasdaq.

What makes IUL different from various other policies is that a part of the exceptional payment enters into yearly renewable-term life insurance (Indexed Universal Life premium options). Term life insurance policy, additionally referred to as pure life insurance policy, warranties survivor benefit settlement. The rest of the worth enters into the general cash worth of the plan. Maintain in mind that fees have to be deducted from the value, which would certainly decrease the money worth of the IUL protection.

An IUL plan could be the best option for a customer if they are trying to find a long-lasting insurance coverage product that builds wealth over the life insurance term. This is since it uses potential for development and also retains the many worth in an unsteady market. For those that have considerable properties or wealth in up-front financial investments, IUL insurance policy will be a wonderful wide range management device, particularly if a person desires a tax-free retired life.

What is the difference between Iul Account Value and other options?

The price of return on the plan's cash value rises and fall with the index's movement. In comparison to various other policies like variable universal life insurance policy, it is much less high-risk. Urge customers to have a discussion with their insurance representative about the most effective option for their conditions. When it concerns looking after beneficiaries and taking care of wealth, here are several of the top reasons that a person may select to choose an IUL insurance plan: The money value that can build up because of the rate of interest paid does not count towards revenues.

This indicates a customer can utilize their insurance coverage payout instead of dipping into their social security cash prior to they prepare to do so. Each policy needs to be customized to the customer's personal requirements, particularly if they are taking care of sizable properties. The insurance holder and the agent can select the amount of risk they take into consideration to be suitable for their requirements.

IUL is a general quickly adjustable strategy. As a result of the rate of interest of global life insurance policies, the rate of return that a customer can potentially obtain is greater than other insurance policy protection. This is because the proprietor and the agent can take advantage of call options to increase feasible returns.

What types of Iul Death Benefit are available?

Insurance holders may be drawn in to an IUL plan because they do not pay funding gains on the added cash money worth of the insurance coverage plan. This can be contrasted to various other policies that need taxes be paid on any kind of money that is obtained. This means there's a cash money property that can be obtained at any type of time, and the life insurance policyholder would certainly not need to bother with paying tax obligations on the withdrawal.

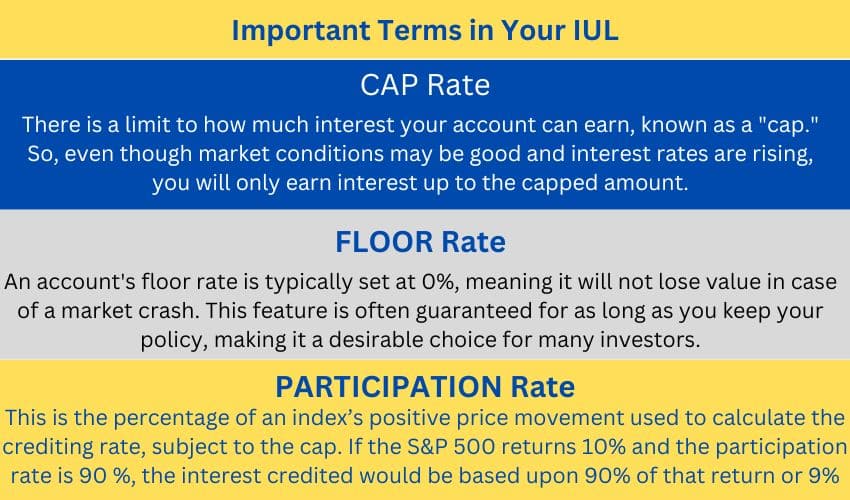

While there are numerous different advantages for an insurance policy holder to pick this kind of life insurance policy, it's not for every person. It is crucial to let the customer know both sides of the coin. Below are a few of one of the most vital points to encourage a customer to take into account prior to selecting this choice: There are caps on the returns a policyholder can get.

The finest alternative relies on the customer's threat tolerance - Indexed Universal Life protection plan. While the costs connected with an IUL insurance plan deserve it for some customers, it is essential to be in advance with them concerning the prices. There are superior cost costs and other management costs that can start to add up

No ensured interest rateSome other insurance policy policies offer a passion price that is ensured. This is not the case for IUL insurance policy.

Indexed Universal Life Retirement Planning

It's attributing rate is based on the performance of a stock index with a cap price (i.e. 10%), a flooring (i.e.

8 Permanent life long-term consists insurance policy two types2 whole life and universal lifeGlobal Money value grows in a taking part whole life plan through returns, which are proclaimed every year by the business's board of supervisors and are not guaranteed. Cash money value grows in an universal life plan via credited passion and reduced insurance prices.

Can I get Iul Plans online?

Regardless of exactly how well you prepare for the future, there are events in life, both anticipated and unexpected, that can influence the financial well-being of you and your liked ones. That's a reason for life insurance. Fatality advantage is typically income-tax-free to beneficiaries. The survivor benefit that's typically income-tax-free to your recipients can assist ensure your family will have the ability to keep their standard of living, help them keep their home, or supplement shed earnings.

Points like potential tax obligation rises, inflation, economic emergency situations, and preparing for occasions like university, retirement, or perhaps weddings. Some kinds of life insurance coverage can aid with these and various other problems too, such as indexed global life insurance policy, or just IUL. With IUL, your plan can be a funds, because it has the possible to construct worth with time.

An index might influence your rate of interest credited, you can not invest or straight take part in an index. Below, your plan tracks, however is not actually spent in, an external market index like the S&P 500 Index.

Costs and expenses may lower plan worths. You can additionally select to receive set passion, one set predictable passion rate month after month, no issue the market.

What are the top Indexed Universal Life Premium Options providers in my area?

That leaves extra in your plan to potentially keep growing over time. Down the roadway, you can access any type of readily available cash worth through policy fundings or withdrawals.

Latest Posts

Index Universal Life Vs Whole Life

Best Indexed Universal Life Insurance

Guaranteed Universal Life Quotes